|

.

|

|

|

|

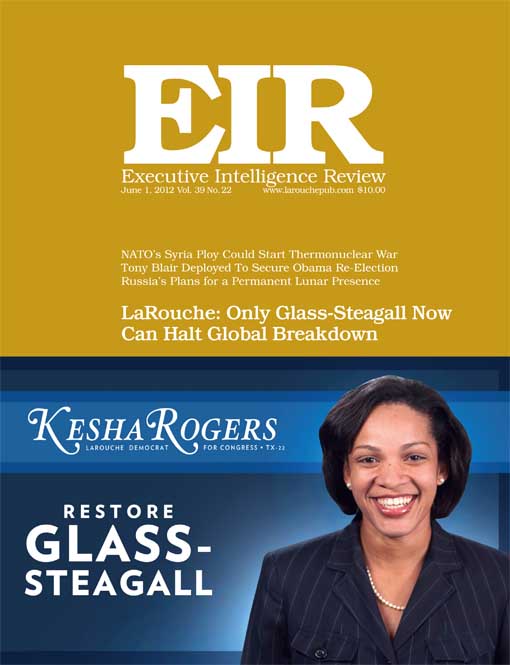

LaRouche:

Only Glass-Steagall Now Can Halt Global Breakdown

by the Editors

May 29—Abruptly, but lawfully, the Spanish debt crisis has erupted into a systemic rupture in the entire trans-Atlantic financial and monetary facade, posing the immediate question: How far will the European Monetary Union and the entire trans-Atlantic financial system survive into the days or weeks ahead? The collapse is upon us.

Late on Friday afternoon May 25, the Spanish government revealed that bailing out the Bankia bank, which was nationalized on May 9, will cost Spanish taxpayers nearly EU24 billion—and rising. Many other Spanish banks are facing imminent collapse or bailout; the autonomous Spanish regions, with gigantic debts of their own, are all bankrupt and desperate for their own bailouts. Over the past week, Spanish and foreign depositors have been pulling their money out of the weakest Spanish banks in a panic, in a repeat of the capital flight out of the Greek banks months ago.

But the Spanish government's bank bailout fund had only EU5.4 billion in its coffers, so two days later, Prime Minister Mariano Rajoy announced a new plan to bail out Bankia with government bonds—basically, funny money. The next day, in the face of plunging markets and soaring interest rates, Rajoy called a press conference to repudiate his plan, and plead instead for a direct bailout by the European Financial Stability Facility (EFSF). The funds for Bankia, of course, would only be the beginning, as the government estimates that other Spanish banks need an additional EU50-60 billion... |

|

|

|

|

|

|

|

Subscribe to EIR Online

For all questions regarding your subscription to EIR Online, or questions or comments regarding the EIR Online website's contents or design, please contact eironline@larouchepub.com.

All rights reserved © 2012, EIRNS |

|

|